nh food tax rate

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb. Official NH DHHS COVID-19 Update 34b.

New Hampshire Sales Tax Rate 2022

Income tax is not levied on wages.

. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Concord City Hall 41 Green Street Concord NH 03301 Phone. Mingnang Chen Mingnangc Profile Pinterest The assessed value multiplied by the tax rate equals the annual real estate tax.

Additional exemptions exist for seniors or disabled individuals. You only have to file a New Hampshire Income Tax Return if you have earned over 2400 annually 4800 for joint filers in taxable dividend and interest income. New hampshires meals and rooms tax is a 9 tax on room rentals and prepared meals.

Quarterly Fund Balance Reductions and. This is the Connecticut state sales tax rate plus and additional 1 sales tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Homeowners pay an average effective property tax rate of 205 the fourth-highest rate in the US. Other taxes in New Hampshire include a cigarette tax a gas tax and an excise tax on beer.

2022 New Hampshire state sales tax. Gail Stout 603 673-6041 ext. New Hampshire meals and rooms tax rate drops beginning Friday.

1227 PM EDT Oct 1 2021 KC Downey. New Hampshires individual tax rates apply to interest and dividend income only. Cost Per Pupil By District Cost per Pupil is based on current expenditures as reported on each school districts Annual Financial Report DOE-25.

The 2021 tax rate for Londonderry is 1838 per 1000. Cost per pupil represents current expenditures less tuition and transportation costs. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety RSA 261.

Employers can view their current and prior quarter tax rates on our WEBTAX System. TOP 2 LOWEST TAX RATES BY COUNTY. Valuation Municipal County State Ed.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. View current and past tax rates.

Year Rate Assessed Ratio. For more information on motor vehicle fees please contact the. Food Service guidance issued on May 18 2020.

Capital and debt service are not current. The ratio for 2021 is 961 the 2022 ratio has not been established yet by the Department of Revenue. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives House Bill 1590 - License.

Any food service revenue is deducted from current expenditures before dividing by ADM in attendance. There are however several specific taxes levied on particular services or products. A 9 tax is also assessed on motor vehicle rentals.

Tax rate drops from 9 to 85. See also the City of Manchester Finance Department for a look at historical property tax rates. A 9 tax is also assessed on motor vehicle rentals.

If you spend less than the 6100 per diem you can generally keep the remainder. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by eating establishments caterers or grocery stores is 735. Annual Tax Rate Determination Letters mailed August 26 2021 for the period 712021 Q32021 through 6302022 Q22022.

Copy copyShortcut to copy Link copied. Exact tax amount may vary for different items. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only.

Although the Department makes every effort to ensure the accuracy of data and information. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Your average tax rate is 222 and your marginal tax rate is 361this marginal tax rate means that your immediate additional income will be taxed at this rate.

State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate. The meals incidentals rate mie rate of 6100 is intended to cover the costs of a single days worth of meals and incidental costs such as tips and parking based on the. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

133 rows New Hampshire Tax Rates. Transparency New Hampshire State of New Hampshire. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

There is also a 85 tax on car rentals. In fact excise taxes are one of the largest sources of revenue for. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils Total Commitment 268913486 581 350 192 1340 2463 34351720 481 395 173 584 1633 367824818 380 263 188 1397 2228. Town of Amherst 2 Main Street Amherst NH 03031 603-673-6041. A net rate of 17 is now allocated as 04 AC and 13 UI.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. Nh food tax calculator. This set annually in October by the Department of Revenue.

Website Disclaimer Government Websites by CivicPlus. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshire is one of the few states with no statewide sales tax.

COVID-19 NH Division of Public Health Services updated December 4 2020. 77 main street lancaster nh 03584. State Education Property Tax Warrant.

Please see the New Hampshire Department of Revenue website for all current information regarding current assessing laws pertaining to The City of Manchester. Official NH DHHS COVID-19 Update 34. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Mark Fernald Why Your Property Taxes Are So High

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

New Hampshire Sales Tax Rate 2022

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

How Do State And Local Sales Taxes Work Tax Policy Center

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

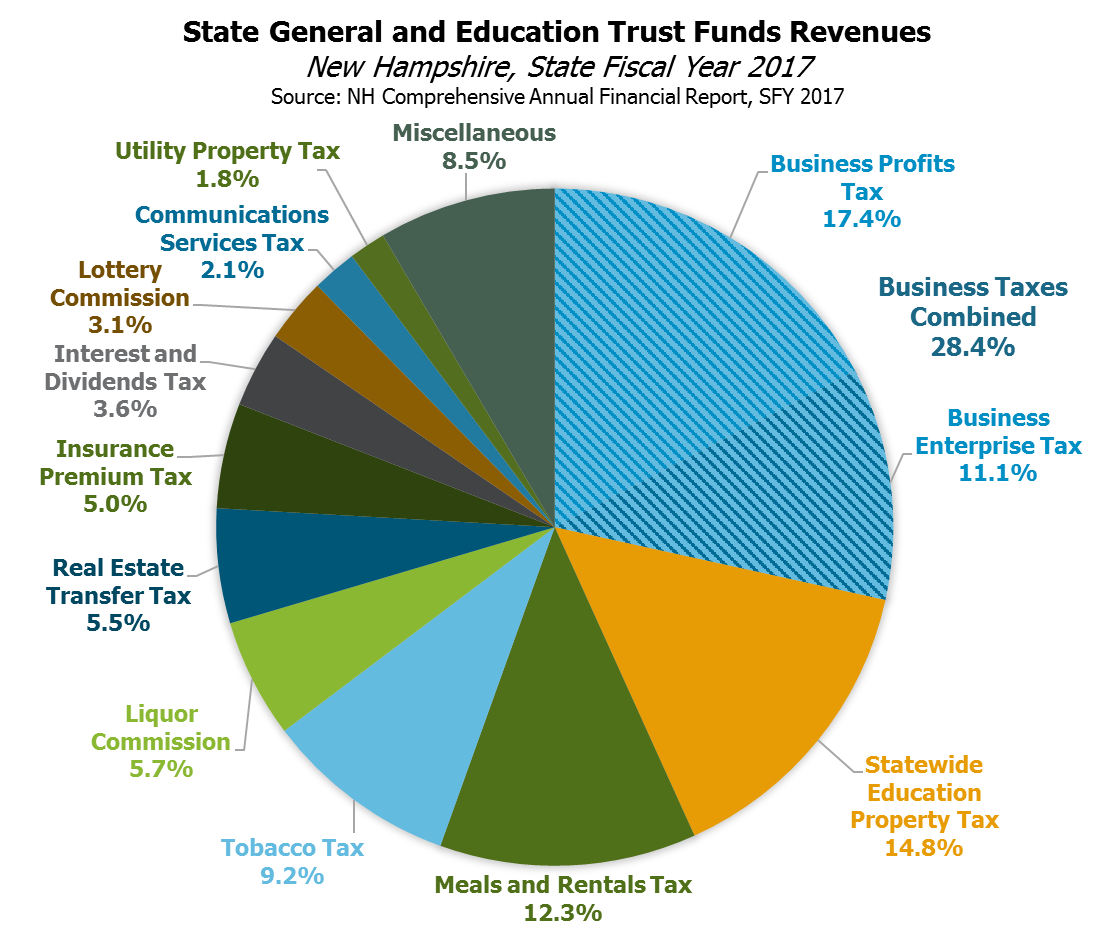

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

New Hampshire Sales Tax Guide And Calculator 2022 Taxjar

Understanding New Hampshire Taxes Free State Project

States Without Sales Tax Article

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

States With Highest And Lowest Sales Tax Rates

New Hampshire Income Tax Calculator Smartasset

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire